Adjuster Agent – What Does That Term Mean?

Adjuster Agent – Can Someone Be Both Simultaneously? Our HQ state North Carolina, now allows adjuster agents. Yes, you can be an adjuster and an

An award-winning leading workers compensation technical blog written by James J Moore that covers all aspects of voluntary market and self-insured costs.

Adjuster Agent – Can Someone Be Both Simultaneously? Our HQ state North Carolina, now allows adjuster agents. Yes, you can be an adjuster and an

WCRI Study Shows How States Build Workers Comp Medical Fee Schedules CutCompCosts.com has always been a fan of workers’ comp medical fee schedules. Try this

Switching Workers Comp Policies Early = Expensive Coverage What prevents insureds from switching workers comp policies constantly or early in the policy period? The short

Very Informative WCIRB Premium Audit Webinar Last week, I watched a live WCIRB Premium Audit webinar that was worth the time. Although the WCIRB covers

California’s WCIRB Pure Premium Rate Increase- Surprising? When the WCIRB pure premium rate increase was announced, words such as “shocking,” “unexpected,” and “surprising” appeared in

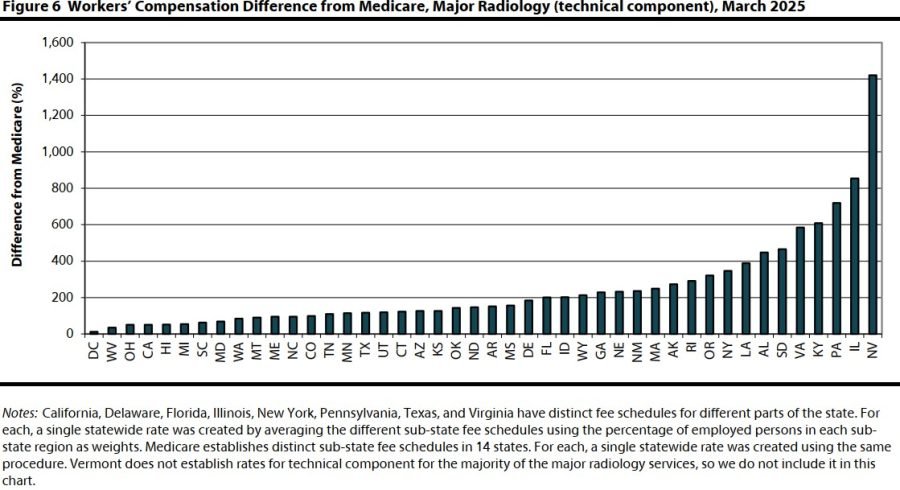

WCRI Annual Free Workers Comp Info – Medical Price Index – 17th Edition One of the best free Workers Comp Info sources on Medical Pricing

2025 NCCI Annual Insights Symposium – Data Overload In A Good Way The 2025 NCCI AIS provided so much good Workers Comp data. I

2025 NCCI State of the Line Report = Healthy Industry With A Great Outlook Donna Glenn, Chief Actuary for NCCI, presented a great outlook for

AI and Workers Comp Claims Management – Not Yet Convinced One of the most popular articles written by me on AI and Workers Comp claims

2025 NCCI State of the Line Podcast – Well Worth 10 Minutes of Your Time I was stuck in an airport, so I thought I

Safety Culture Study – Malaysian Oil and Gas Similar to US Injury Stats This safety culture study was found in the US National Library of

CA’s WCIRB 8810 Class Code Webinar Covered All Clerical Classifications Last month, the WCIRB produced a 8810 Class Code Webinar that is worth a look.

Web Design in Raleigh By Redwood