Overworked Claims Adjusters? – See 2024 Benchmarking Study

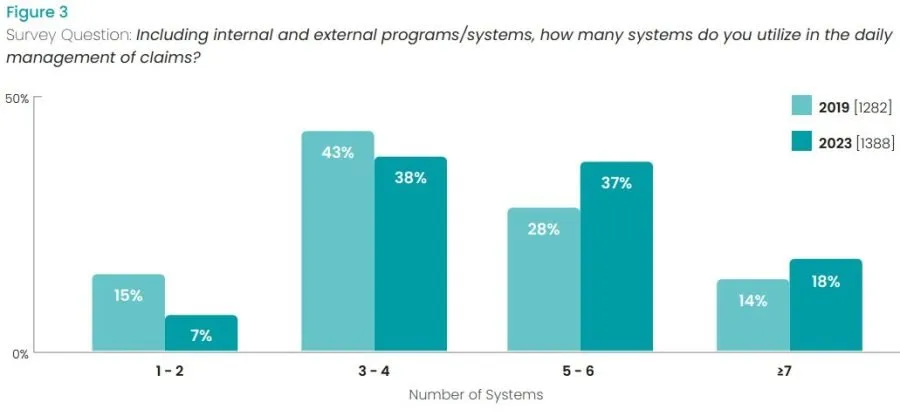

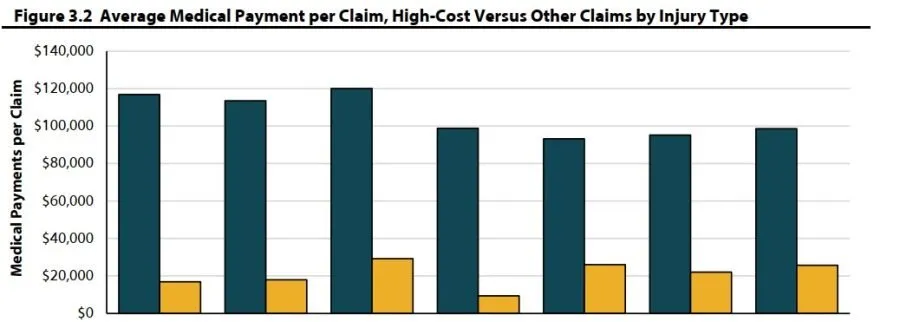

Does This Study Prove Overworked Claims Adjusters Exist? Is this a sign of overworked claims adjusters, or did I incorrectly interpret one of the main

An award-winning leading workers compensation technical blog written by James J Moore that covers all aspects of voluntary market and self-insured costs.

Does This Study Prove Overworked Claims Adjusters Exist? Is this a sign of overworked claims adjusters, or did I incorrectly interpret one of the main

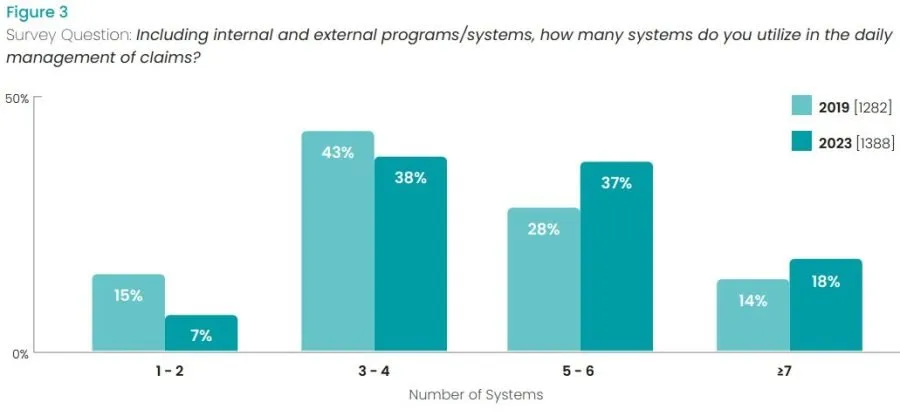

Adjusters, Risk Managers, and Safety – WCRI Shocking Back Injury Numbers I recently read through a WCRI (Workers Comp Research Institute) article that should cause

Third IRS Rule for Independent Subcontractor Determination Yesterday, after discussing independent subcontractor determination with a client employer, I wrote this article covering remote workers. As

Remote Independent Contractors Test Same as Jobsite How does an employer know if their remote independent contractors are not considered employees? One of the most

The Social Security Workers Comp Effect Yesterday, I started to cover the Social Security Workers Comp Effect. I decided to break the article into two

Are Workers Comp Benefits Taxed? – Still #1 Question Phone calls from concerned injured workers during the tax filing season center on one area. Are

WCIRB 2025 Annual Conference – Why 11.2% Rate Increase? The WCIRB 2025 Annual Conference was presented online last week. I miss the days of traveling

Workers Comp Opinions Three Years Ago – Accurate? Recently, I was interviewed by a great reporter on my Workers Comp opinions. The same reporter interviewed

Fastest Way to Read AI Workers Comp Articles We have now seen AI Workers Comp articles proliferate over the last two years. I have written

In Big Beautiful Bill Workers Comp Appears How Many Times? The Big Beautiful Bill Workers Comp reference appears to be an exclusion rather than any

Adjuster Agent – Can Someone Be Both Simultaneously? Our HQ state North Carolina, now allows adjuster agents. Yes, you can be an adjuster and an

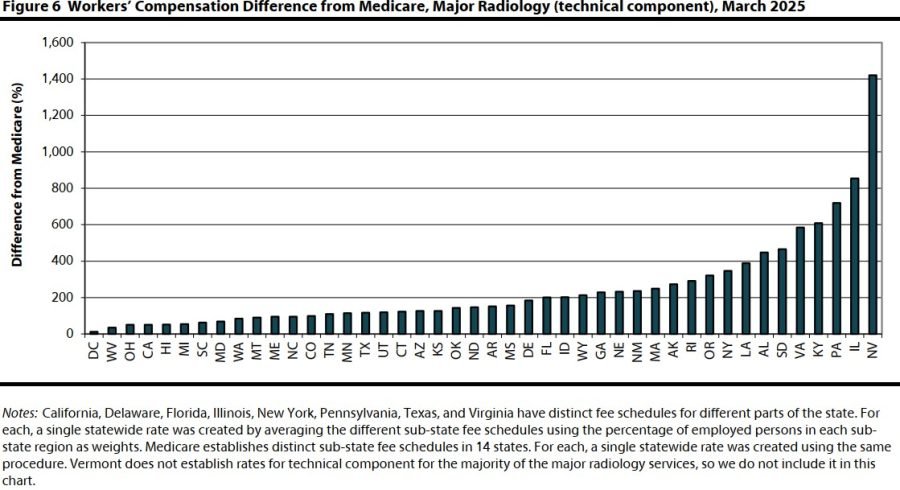

WCRI Study Shows How States Build Workers Comp Medical Fee Schedules CutCompCosts.com has always been a fan of workers’ comp medical fee schedules. Try this