Residual Market – Critical Under The Radar Coverage

In insurance industry they need residual market for Workers Comp.Companies or industries that are considered high risk (for instance with an E-Mod of 1.7 and above) may not be able to obtain Workers Compensation insurance through the regular voluntary markets.

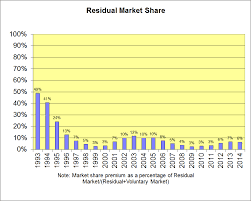

The chart shows the differing level of the residual markets compared to the whole workers comp market. The bars enumerate the insurance crises of the 1990’s. One can see the residual market represented almost half of the market. The crises quickly subsided over the next few years.

Workers Comp in 2023 can now be written profitably as standalone insurance due to the much lower Combined Ratios in the last 7 to 10 years.

(The term “high risk” applies to individuals or individual businesses with a poor loss record due to inadequate safety measures; certain kinds of businesses or professions where the nature of the work is hazardous or where the risk of lawsuits is high; and specific locations where the risk of theft, vandalism or severe storm damage is substantial.)

To make basic coverage more readily available to everyone who wants or needs insurance, special insurance plans, known as residual, shared or involuntary markets, have been set up by state regulators working with the insurance industry.

©J&L Risk Management Inc Copyright Notice