Switching Workers Comp Carriers Too Early Very Costly

Switching workers comp carriers can be a trying task at renewal. During the year, that option can be very costly due to the Short Rate Penalty. The various state insurance departments decided to eliminate or at least heavily discourage employers from jumping from policy to policy to find a better deal.

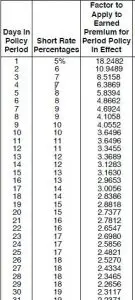

Bringing in another carrier may save some premium. However, the employer has to weigh out the cost/benefit of making such a major move. The charts below – one from Rhode Island/California shows the devastating effect of these midterm changes.

Switching Workers Comp carriers in the first month in California or Rhode Island:

California and Rhode Island have very different workers’ compensation systems. The chart for the short rate penalty is exactly the same for the two states.

Looking at the chart, one can see that the canceling the first day of the policy costs 5% of the total policy. Yes, there are many calculations to the process of the carrier assigning the short rate penalty. The main thing the chart shows is that moving to a new carrier will incur a large penalty for a small number of days covered by the carrier.

Switching workers comp policies after a premium audit dispute cost employers dearly in some cases. The percentages level out after six months into the policy. By then, the carriers figure they have collected enough premium to spread it over the risk, especially the IBNR (Incurred But Not Reported) claims.

I have seen very little carrier leeway with the percentages charged for the short rate penalty. Sometimes, it may be better to ride out the policy and then non-renew with the carrier.

As mentioned earlier, a cost-benefit analysis would be the best way to see if switching workers comp carriers mid-policy will be worth the money and hassle.

©J&L Risk Management Inc Copyright Notice